The Challenge and Opportunity in Omnichannel in the Canadian Retail Marketplace

On December 21st, 2016 the Financial Post published an article by Hollie Shaw on “How Canadian Tire is grappling with the economics of e-commerce”. While this article is focused on Canadian Tire it captures what I believe are the main issues with why the Canadian Retail Market is so far behind the UK and the USA. It also highlights the huge opportunity for the retailer who takes the first mover advantage.

On December 21st, 2016 the Financial Post published an article by Hollie Shaw on “How Canadian Tire is grappling with the economics of e-commerce”. While this article is focused on Canadian Tire it captures what I believe are the main issues with why the Canadian Retail Market is so far behind the UK and the USA. It also highlights the huge opportunity for the retailer who takes the first mover advantage.

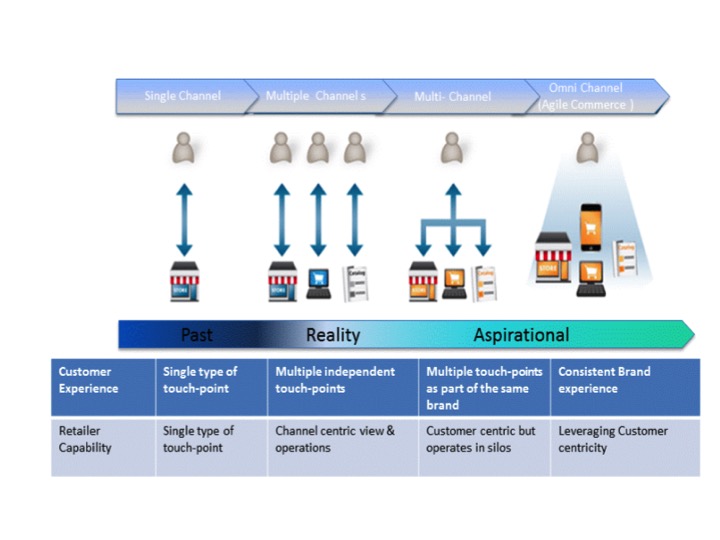

The first challenge presented by the article – “questions in the industry still abound as to whether retailers will be able to support a thriving web operation without putting a serious dent in the profits and sales of their bricks and mortar stores.” Retailers’ in other countries notably the UK and USA addressed this question well over 5 years ago and came to the conclusion that this is not the right question. They realized that Customers do not shop by channel; in fact during their shopping journey they may cross multiple channels as they transverse from awareness, to transaction, to delivery, to after sales care. Customers build their relationship with the brand. Increasingly the lines are blurring between the physical store and digital world by the use of virtual changing rooms, virtual stores, mobile purchasing etc. As a result the concern of cannibalization of store sales by e-commerce sales is irrelevant. The key for the retailer is to build on, their relationship with Customers, enabling Customers’ to interact anywhere anytime they want, hopefully resulting in the retailer increase their share of wallet.

The channel battle is harder to address for retailers like Canadian Tire where their stores are franchises (Dealers), but this is a commercial agreement between head office and the franchises on how to split sales through the digital channels. The Customer does not care!

An aside point: This new retail model has been referred to as Omni-channel, which 2 years ago articles in the US began appearing stating that Omni-channel is becoming the norm and is just the new retail reality.

The question is what is the role of stores in a Customer Centric Omni-channel world needs to be addressed by each retailer in order to ensure that the physical store experience is brand appropriate. A good example of this is Restoration Hardware who decided that their stores are to be showrooms and that purchases will be shipped to your house. To support this change in their operating model they now refer to their stores a galleries, have reduced the number of stores and opened up a smaller number of larger stores (galleries). This has been a brilliant move for them, very retailer needs to understand their value proposition and determine the role of their stores should going forward.

The next challenge presented by the article “because the economics of e-commerce aren’t there yet”. This is an interesting challenge that I have heard a lot about in Canada. I believe this is a reflection on:

- Where the Canadian market is on the maturity cure of digital commerce

- And on the unique challenges in Canada due to our population density and vast land mass

Based on the work I have done in other countries profitable e-commerce operational models can be implemented. These models need to take into account the various categories of product being sold, the physical size of the product, profit margins, Customer population densities, store and DC locations etc. National retailers such as Home Depot, Wal-Mart, and Canadian Tire etc. have a significant advantage with their store base, as they can build strong fulfillment networks by utilizing their stores and DCs. These blended networks can reduce costs and improve on Customer service.

“Click and Collect” has become a common model for retailers to offer Customers in Canada. While this is an important option to provide retailers need to offer the Customer a full range of choices:

- Click and Collect

- Click and home delivery

- In-store order and home delivery

- Reserve online purchase in-store ?

- Deliver to lockers and 3 party solutions ?

- Return via any channel regardless of purchase channel ?

- Speed of delivery; ?o Standard free delivery (3 to 5 days)?

- Premium delivery – same day, next day, named day & time

The First Mover Advantage:

The general business strategy prevalent in Canada is to be a fast follower, but becoming a Customer – Centric Omni-channel retailer is not quick and easy to obtain, as it requires:

- A mindset change

- Organizational changes

- Business process changes

- Technological changes

As a result there is a huge first mover advantage. The question is whether an established retailer in the Canadian retail market is going to make the move or whether a new entrant will shake up the market? Maybe powerful Omni-channel retailer, like Nordstrom.

Contact us to learn how spice™ can help your business.

About the Author:

Ian Rogers is an accomplished business leader with 20+ years in Retail / Supply Chain Management, Portfolio, Program, and Project Management. Ian’s expertise comes from working in multiple countries (Canada, UK, US,  China) and in multiple sectors including manufacturing and multi- channel retail (office products, mass merchandising, lifestyle brands). Over the years Ian has worked with companies as both a senior line leader and as a management consultant in Supply Chain and IT. This broad based experience provides him with the ability to take a holistic view, thereby understanding the potential impact changes in one area of the business will have on other areas.

China) and in multiple sectors including manufacturing and multi- channel retail (office products, mass merchandising, lifestyle brands). Over the years Ian has worked with companies as both a senior line leader and as a management consultant in Supply Chain and IT. This broad based experience provides him with the ability to take a holistic view, thereby understanding the potential impact changes in one area of the business will have on other areas.